Before applying for a car title loan without a bank account in San Antonio, meet eligibility criteria (age 18+, valid license, vehicle ownership with equity), prepare ID, income proof, registration, insurance, and compare lenders offering secured loans with competitive rates, flexible terms, and reliable service to secure faster approval based on your financial capabilities.

Looking for a quick cash solution with no bank account? A car title loan could be an option. This guide walks you through the steps to apply, focusing on securing a loan without the traditional banking requirements. First, understand the eligibility criteria based on your vehicle’s value and personal information. Next, gather essential documents like your vehicle’s registration and proof of insurance. Compare lenders to find the best rates and terms, ensuring a secure and transparent transaction.

- Understand Eligibility Requirements for Car Title Loans

- Gather Necessary Documents for Application

- Compare Lenders and Choose the Right One

Understand Eligibility Requirements for Car Title Loans

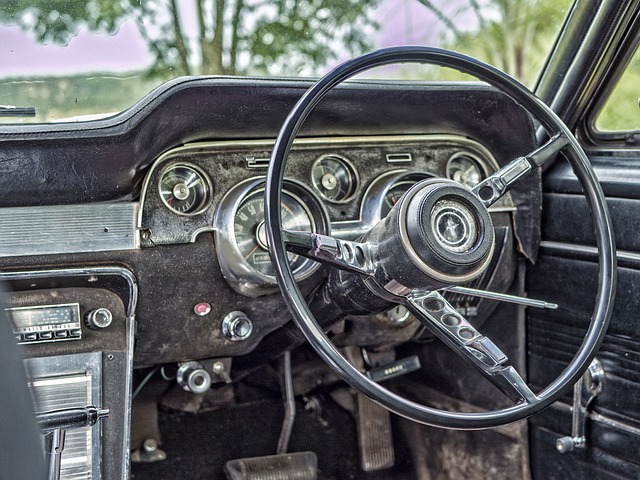

Before applying for a car title loan without a bank account, it’s crucial to understand the eligibility criteria set by lenders. Most reputable car title loan providers require applicants to meet specific standards, such as being at least 18 years old and having a valid driver’s license. Additionally, you’ll need to own a vehicle that has significant equity, meaning the loan amount should be less than the value of your car. This ensures that the lender has collateral in case of default.

Secured loans like car title loans are popular among individuals without traditional banking access as they offer faster approval times compared to other types of loans. The process involves a quick vehicle inspection to assess its value and condition, followed by a simple application process. In San Antonio loans, for instance, many lenders cater to this specific need, providing an alternative financing option where bank accounts are not required.

Gather Necessary Documents for Application

When applying for a car title loan without a bank account, having the right documents on hand is crucial for a smooth and efficient process. You’ll need to provide proof of identification, such as a valid driver’s license or state ID card, to establish your identity. Additionally, gathering documents that demonstrate your income source, like pay stubs or tax returns, will expedite the loan approval process. These essential items ensure lenders can verify your financial standing and make informed decisions regarding your application for a car title loan without bank account.

Don’t forget to prepare the necessary paperwork related to your vehicle, including its registration and proof of insurance. Since vehicle collateral is a key aspect of this type of loan, lenders will assess the condition and value of your car to determine eligibility. Having these documents ready demonstrates your preparedness and can contribute to a faster loan approval.

Compare Lenders and Choose the Right One

When considering a car title loan without a bank account, comparing lenders is a crucial step in making an informed decision. This process involves assessing various factors such as interest rates, loan terms, and repayment conditions. Each lender will have different loan requirements and policies regarding collateral, so it’s essential to read through their terms and conditions carefully. You can start by researching online or asking for recommendations from friends who have taken out similar loans.

Choosing the right lender is about finding a balance between competitive rates, flexible terms, and reliable customer service. Opting for a secured loan like a car title loan ensures that you have a backup plan should you be unable to repay. However, remember that loan refinancing during the tenure of the loan may not always be feasible without additional fees or penalties. Compare offers from multiple lenders to find the best fit based on your current financial situation and future repayment capabilities.

Applying for a car title loan without a bank account is feasible by adhering to specific steps, including understanding eligibility criteria, gathering required documents, and carefully comparing lenders. This alternative financing method allows individuals with limited banking options to access much-needed funds secured by their vehicle’s title. By choosing a reputable lender and ensuring you meet the necessary requirements, you can navigate this process smoothly and potentially gain access to quick cash during emergencies or for unexpected expenses.