Car title loans offer quick cash access for individuals lacking traditional banking services, using their vehicle's title as collateral. With flexible payments tailored to budget and a straightforward 2-step process, these loans are ideal for those with limited or no credit history. Despite higher interest rates and restrictive borrowing conditions, they provide urgent solutions for folks without a bank account.

Looking for a quick funding solution with no bank account? A car title loan could be an alternative financing option worth considering. In this article, we’ll guide you through the process of securing a car title loan without a traditional bank account. We’ll explore what these loans are, how to access them, and their unique benefits and considerations. Discover a potential path to financial support by leveraging your vehicle’s equity.

- Understanding Car Title Loans: An Alternative Financing Option

- The Process: Getting a Car Title Loan Without a Bank Account

- Benefits and Considerations for This Loan Type

Understanding Car Title Loans: An Alternative Financing Option

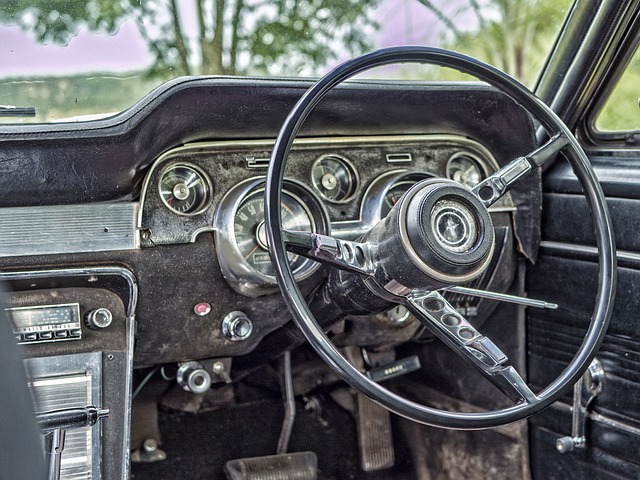

Car title loans have emerged as an attractive alternative financing option for individuals seeking financial assistance outside traditional banking channels. This type of secured loan allows borrowers to use their vehicle’s title as collateral, providing access to capital without the stringent requirements often associated with bank loans, including a checking or savings account. By leveraging Vehicle Ownership as security, lenders can offer flexible payments tailored to the borrower’s budget, making it an appealing solution for those in need of quick funding.

Unlike bank loans that may require extensive documentation and strict eligibility criteria, car title loans provide a more straightforward process. Borrowers typically need to present their vehicle’s registration, proof of insurance, and a valid driver’s license. The lender assesses the vehicle’s value and offers a loan amount based on this assessment, ensuring that even those without a robust credit history can access Financial Assistance when they need it most. This flexibility in payments and eligibility criteria makes car title loans an attractive option for individuals looking to maintain their financial independence while securing a loan.

The Process: Getting a Car Title Loan Without a Bank Account

Obtaining a car title loan without a bank account is a straightforward process that involves just a few simple steps. First, individuals interested in this option must own a vehicle with a clear title and have a stable source of income. They will need to provide proof of these two factors to lenders, as they serve as the primary collateral for the loan. Once verified, borrowers can apply online or through a local lender offering Dallas title loans.

The application requires sharing personal details, vehicle information, and income proof. After submission, lenders will assess the request promptly, often providing fast cash within the same day. Unlike traditional bank loans that may require extensive documentation and take longer to disburse, this method offers a quicker alternative for those in need of immediate financial assistance, ensuring they can access their hard-earned money without relying on a traditional banking system.

Benefits and Considerations for This Loan Type

A car title loan without a bank account offers several advantages for individuals who need quick cash access but lack traditional banking services. This alternative financing option allows borrowers to use their vehicle’s title as collateral, providing them with a secure and fast way to obtain funds. One significant benefit is that it caters to those with limited or no credit history, as it isn’t strictly based on financial background; instead, the primary focus is on the vehicle’s value and the borrower’s ability to repay.

When considering this loan type, it’s essential to evaluate potential drawbacks. Interest rates tend to be higher compared to conventional loans due to the shorter term and collateral-based nature of car title loans. Additionally, borrowers must be prepared to surrender their vehicle’s registration and title during the loan period, which can impact their mobility and ownership flexibility. However, for those in urgent need of cash and lacking a bank account, this option provides a viable solution with potential benefits outweighing the considerations.

If you’re seeking quick cash and don’t have a traditional bank account, a car title loan without a bank account can provide a viable solution. By leveraging your vehicle’s equity, this alternative financing option offers flexibility and accessibility. However, it’s crucial to weigh the benefits against potential risks, such as interest rates and potential repossession, before proceeding. Understanding the process and thoroughly considering your financial situation will ensure you make an informed decision.