Car title loans offer a flexible financing solution for individuals without traditional banking services, particularly beneficial for semi-truck operators. Lenders assess vehicle ownership and condition instead of credit history or bank accounts, providing quick cash access using the car title as collateral. This alternative allows borrowers to secure funds, keep their vehicles, and manage repayments with less stringent requirements compared to conventional loans.

Need a loan quickly, but lack a bank account? Explore car title loans as an alternative financing option. This option allows you to borrow money using your vehicle’s title, even without traditional banking. In this article, we’ll delve into how car title loans work, the eligibility criteria for those without a bank account or debit card, and highlight the benefits of this unique borrowing solution.

- Understanding Car Title Loans: An Alternative Financing Option

- Eligibility Criteria for Car Title Loans Without Traditional Banking

- The Process and Benefits of Securing a Car Title Loan Without a Bank Account

Understanding Car Title Loans: An Alternative Financing Option

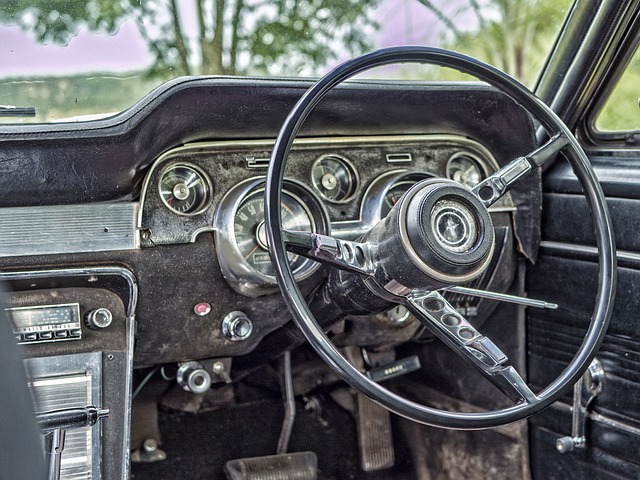

Car title loans have emerged as an alternative financing option for individuals who need quick cash access but lack traditional banking services. This type of secured loan allows borrowers to use their vehicle’s title, typically their car or truck, as collateral. Unlike bank loans that often require a robust credit history and a checking account, car title loans offer flexibility by not mandating these conditions. Borrowers can obtain funds by simply providing the vehicle’s registration and a clear title, making it an attractive option for those without a bank account or poor credit.

In the case of Dallas Title Loans or similar services, individuals with semi-truck operations might find this method particularly useful. Secured loans backed by vehicles provide peace of mind as the lender has a legal claim to the asset if the borrower defaults. This ensures that even without a traditional banking setup, borrowers can access much-needed funds for various purposes, from unexpected expenses to business investments, thereby filling a gap in the financial services landscape.

Eligibility Criteria for Car Title Loans Without Traditional Banking

When considering a car title loan without a bank account or debit card, understanding the eligibility criteria is paramount. Lenders offering these alternative loans typically require proof of vehicle ownership and a valid driver’s license as minimum standards. The primary focus is on the value and condition of your vehicle rather than your traditional banking status. This means even those without a bank account can still access much-needed funds by using their car title as collateral.

The process involves evaluating your vehicle’s market value and assessing your ability to repay the loan, often through automated payments linked to your vehicle registration or other authorized methods. Interest rates may vary among lenders, but understanding the cost of borrowing is crucial before finalizing any agreement. Efficient loan refinancing options can help borrowers manage their debt more effectively, aiming for a swift payoff to regain full control over their finances.

The Process and Benefits of Securing a Car Title Loan Without a Bank Account

Securing a car title loan without a bank account is a straightforward and appealing option for many individuals who need quick cash access. This alternative financing method allows lenders to use your vehicle’s title as collateral, providing a fast and efficient solution for borrowers. The process typically involves less stringent requirements compared to traditional loans, making it accessible to a broader range of applicants.

One significant benefit is that you, the borrower, retain possession of your vehicle throughout the loan period. This means you can continue driving while repaying the loan, which is particularly advantageous for those reliant on their car for daily transportation or work purposes. Fort Worth loans, offering this option, cater to a diverse range of borrowers, ensuring they keep their vehicles as valuable assets and a source of financial security. Additionally, using your vehicle as collateral ensures a more straightforward borrowing experience without the need for complex banking procedures.

Online car title loans without a bank account offer a flexible financing solution for individuals with limited banking options. By utilizing your vehicle’s equity, you can gain access to cash quickly and easily, without the need for traditional banking relationships. This alternative lending method is particularly beneficial for those with poor credit or no bank account, providing a fast and convenient way to secure funds when other options may be scarce. Remember, while car title loans can be helpful in urgent situations, it’s crucial to understand the terms and conditions before borrowing to ensure a positive financial outcome.