Car title loans have emerged as a popular alternative financing method for freelancers and independent contractors who lack traditional banking services or struggle with conventional loans. These loans allow individuals to borrow money using their vehicle's equity as collateral, offering quick cash with direct deposits into the borrower's account. Unlike banks, lenders focus on the vehicle's value and ownership rather than strict credit history. Key factors include gathering essential documents (driver's license, vehicle paperwork, income proof), structured repayment plans ranging from $100 to $5,000, and maintaining timely repayments to preserve credit standing and potentially refinance for lower interest rates. Car title loans without a traditional bank account provide liquidity with competitive interest rates, making them an attractive option for those who need immediate financial support.

“For freelancers lacking a traditional bank account, securing funding can be a challenge. Enter car title loans as a viable alternative. This article explores how self-employed individuals can leverage their vehicle’s equity for emergency cash flow or business investments. We’ll break down the ins and outs of ‘car title loan without bank account’ arrangements, focusing on eligibility criteria, application processes, and repayment options tailored to freelancers’ unique circumstances. By the end, you’ll understand how this non-traditional loan type can provide a reliable financial safety net.”

- Understanding Car Title Loans for Freelancers

- Eligibility Criteria for Car Title Loan Without Bank Account

- How to Secure and Repay Your Car Title Loan?

Understanding Car Title Loans for Freelancers

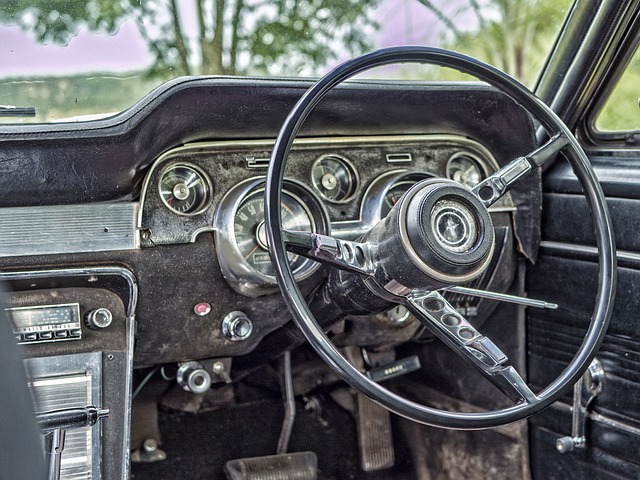

Car title loans have emerged as a popular option for freelancers and independent contractors who may lack traditional banking services or face challenges in accessing conventional loans. This alternative financing method allows individuals to borrow money using their vehicle’s equity as collateral, providing a quick and convenient solution for immediate financial needs. For those without a bank account, a car title loan can be particularly appealing as it offers a direct deposit of funds into the borrower’s possession, enabling them to manage their finances autonomously.

Freelancers often face irregular income streams and may require access to capital during periods of slow work. By utilizing their vehicle’s value, they can secure a loan with competitive interest rates, providing much-needed flexibility in managing expenses and investments. This approach eliminates the need for complex credit checks or extensive documentation typically associated with bank loans, making it an accessible and attractive option for self-employed individuals seeking financial support.

Eligibility Criteria for Car Title Loan Without Bank Account

When considering a car title loan without a bank account, it’s important to understand the eligibility criteria. Lenders typically require that borrowers have a valid driver’s license and proof of vehicle ownership—a clear car title in their name. While traditional loans may demand a robust credit history, these alternative financing options often focus more on the value of your vehicle than on your credit score. Being an independent contractor or freelancer can work in your favour as lenders are increasingly catering to this demographic with flexible repayment terms and less stringent requirements.

One significant advantage is that you can keep your vehicle as collateral for the loan, ensuring it remains your possession throughout the borrowing process. Unlike bank loans that might require direct deposits into a checking account, these car title loans provide a hassle-free way to access funds without needing a traditional banking relationship. Moreover, if you successfully repay the loan on time, you can extend the terms or even refinance in the future, giving you more control over your finances and offering potential savings on interest rates compared to other short-term financing options.

How to Secure and Repay Your Car Title Loan?

Securing a car title loan without a bank account is entirely possible for freelancers who rely on alternative income streams and flexible work arrangements. The first step involves gathering essential documents, such as your driver’s license, vehicle registration, proof of income (like 1099 forms), and a valid photo ID. These documents are crucial for establishing your identity and verifying your financial status.

Repayment typically occurs in structured installments, with loan amounts ranging from $100 to $5,000, based on your vehicle’s value and Loan Requirements. Many lenders offer direct deposit options, facilitating timely repayments directly into your personal checking account or other designated accounts. Ensuring prompt repayment is key to avoiding penalties and maintaining a good credit standing. Remember that loan approval often hinges on your vehicle’s condition, making it a practical solution for those in need of quick cash without the constraints of traditional banking systems.

For freelancers lacking a traditional bank account, car title loans offer a viable solution for quick cash. By leveraging their vehicle’s equity, they can access funding without the usual banking requirements. Understanding the eligibility criteria and secure repayment methods is key to making an informed decision. Car title loans without a bank account provide a convenient and accessible option for those in need of immediate financial support.