Car title loans provide fast cash access for individuals lacking traditional banking or stable income, using vehicle ownership as collateral. Key steps involve understanding eligibility criteria, verifying employment & income (with alternative documents acceptable), comparing lender terms & rates, and securing the loan with your vehicle's title to gain immediate financial support – a viable solution even without a bank account.

Looking for fast financing options with no bank account or proof of income? Discover how car title loans can provide an alternative solution. This type of secured loan uses your vehicle’s equity as collateral, allowing you to access cash without traditional banking requirements. In this article, we’ll explore who qualifies, the simple process involved, and why car title loans without a bank account are a viable choice for short-term financial needs.

- Understanding Car Title Loans: An Alternative Financing Option

- Eligibility Criteria: Who Can Apply Without a Bank Account?

- The Process: Getting a Loan Despite Lack of Traditional Documentation

Understanding Car Title Loans: An Alternative Financing Option

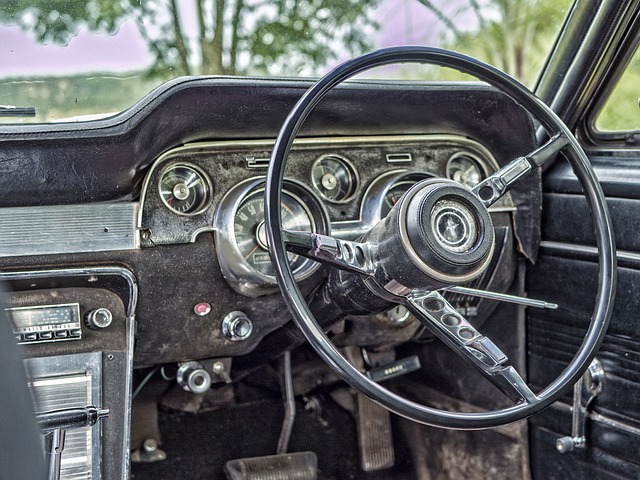

Car title loans have emerged as an alternative financing option for individuals who need quick cash and don’t have a traditional bank account or stable income. This type of loan uses your vehicle’s ownership as collateral, allowing lenders to offer fast approval and funding without the usual stringent requirements. Unlike typical bank loans that demand extensive paperwork and credit checks, car title loans provide a simpler process, making them appealing to those with limited financial resources or poor credit history.

By leveraging your vehicle’s value, you can obtain semi truck loans or personal loans secured by your car, offering quick funding when traditional methods may fall short. This alternative approach ensures that individuals who are employed but lack formal banking services can still access the financial support they need for various purposes, maintaining their Vehicle Ownership and avoiding potential pitfalls associated with late payments.

Eligibility Criteria: Who Can Apply Without a Bank Account?

When considering a car title loan without a bank account, it’s important to understand that eligibility criteria may vary between lenders. Traditionally, having a bank account is often required to establish financial trust and facilitate secure transactions. However, some lenders specialize in offering title pawn services to individuals who don’t have access to traditional banking services. These loans are secured by the title of your vehicle, making them an attractive option for those with limited or no bank account.

Candidates for car title loans without a bank account typically include those with stable jobs and verifiable income sources. While a bank statement might not be required, lenders will need to confirm your ability to repay the loan. This can often be done through alternative means such as pay stubs, employment verification, or even tax documents. The loan terms and interest rates for these loans may differ from conventional loans; they are designed to cater to individuals with unique financial circumstances, so it’s crucial to understand the specific conditions offered by each lender, including any potential fees associated with early repayment or extended loan periods.

The Process: Getting a Loan Despite Lack of Traditional Documentation

When it comes to securing a loan without a traditional bank account or proof of income, one option that often gains traction is the car title loan. This alternative lending method has gained popularity due to its accessibility for individuals who may not meet the stringent requirements of conventional loans. The process involves using your vehicle’s ownership as collateral, providing a quick and efficient way to gain access to cash.

Applying for a car title loan without bank account or income verification is straightforward. Lenders will assess the value of your vehicle and offer a loan amount based on that assessment. Repayment options typically include flexible installments, allowing borrowers to pay back the loan over an agreed-upon period. This secured loan process ensures lenders have recourse in case of default, making it a viable solution for those in need of immediate financial assistance.

Car title loans offer a unique financing solution for individuals who may struggle to meet traditional eligibility requirements, especially those without a bank account or stable income. By using your vehicle’s equity as collateral, you can access funds quickly and efficiently. While this alternative option is not without its considerations, it provides a viable path for folks in need of immediate financial support. Remember that understanding the process and terms is crucial to making an informed decision when opting for a car title loan without a bank account or traditional income verification.